Investors and traders always are looking for an edge in forecasting stock prices to improve their trading results.When investment professionals as a group make their decisions,they often analyze fundamental information such as economics,politics and demographics.They look back to the past to forecast what may happen in future.Investors and speculators react the same way to the same types of events again and again.It means they are employing technical analysis of the markets.This discipline relies on generous amount of historical price data,readily available in computer applications.

The biggest advantage of using a historical database in making trading decisions is that it gives the analyst perspective.A sharp price increase in one stock may be taken as a bullish sign until it is viewed as part of a longer chart that has been declining for the past six months.A chart is nothing but making patterns of price movements over time.

By plotting the closing prices of stocks each day,you can get the basic chart of that stock and you will come to know in which direction the stock price is heading.

Below is the one year chart of Apple Inc by depicting a daily closing price.

The biggest advantage of using a historical database in making trading decisions is that it gives the analyst perspective.A sharp price increase in one stock may be taken as a bullish sign until it is viewed as part of a longer chart that has been declining for the past six months.A chart is nothing but making patterns of price movements over time.

By plotting the closing prices of stocks each day,you can get the basic chart of that stock and you will come to know in which direction the stock price is heading.

Below is the one year chart of Apple Inc by depicting a daily closing price.

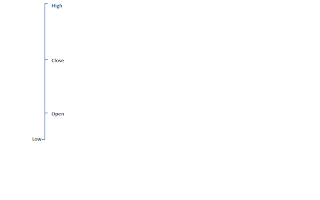

Stock charts come in many flavors.Some prominent ones include point and figure chart,candlestick chart and the ever-popular bar chart.The bar chart is the main market analysis tool in the western world and a key component of technical analysis worldwide.Bar charts are easy to create,interpret and maintain.Each individual bar use daily open,high,low and close price.They are plotted together in a vertical line each day as shown below.Overtime,the bars rise and fall to form the chart patterns and we will see in detail.